One of Asia’s blockchain funds, SevenX Ventures, recently reported that SevenX has been investing in the Arweave as a cutting-edge technology since its inception in 2020. “There will be an unparalleled burst of discoveries in the Arweave ecosystem in the next years,” said Eraser Li, a founding partner of SevenX Ventures. ARGO, the Apples augmented reality solution provider, enables developers to deploy DAPP to AR in real time, while ArDrive enables users to use augmented reality as their own data storage solution as easily as they would a network drive connected to the Internet. ARGO is a division of Apple Inc. Among the goods in the SevenX portfolio are the following:

that the second round of its fund has gathered $30 million in total contributions. On August 16th, SevenX was able to recruit new limited partners (LPs) from a variety of backgrounds, including family offices, hedge funds, blockchain industry leaders, and internet firms. The firms stated that they want to proceed with Venture Fund II, which will be focused on DeFi, NFT, WEB3.0, Polkadot ecosystem, NEAR ecosystem, and Arweave’s new ecology of the data storage paradigm, among other technologies.

In any case, since its founding in 2020, the cryptocurrency investment firm SevenX has channelled these money to the benefit of a number of companies, including DODO, YGG, and Acala. These companies have seen great growth as a result of the investment made by SevenX Ventures. SevenX’s initial round of financing saw a 20-fold increase in its first year of operation, setting a new industry benchmark.

SevenX Ventures is currently in the process of developing its portfolio.

SevenX is on the lookout for long-term value projects that employ a long-term development mentality and an underlying logic viewpoint to make a positive difference in the world. As indicated by the following data, SevenX’s portfolio has a large number of success stories:

- SevenX is an angel investor in the DeFi industry, having invested in Opium, Shield, Kine, InsureAce, and DODO as one of the first investment funds dedicated to the field. They were also among the first investors in Furucombo, and in 2020, they made a strategic investment in Zerion, which is a virtual reality platform.

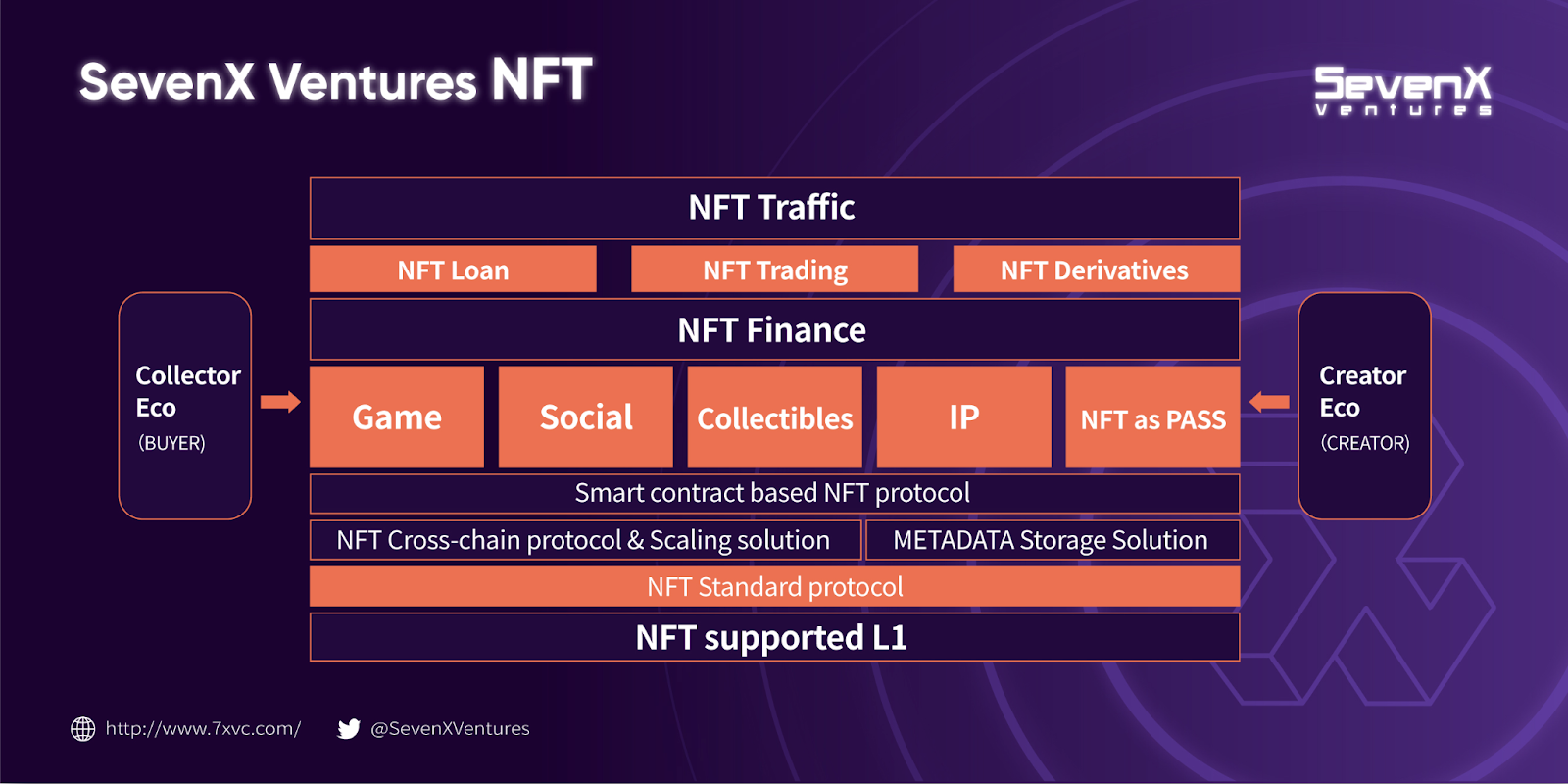

SevenX has developed a matrix layout in the NFT field, which was accomplished via the use of its own logic framework. Together with Framework and Pantera, it co-led the Rangers Protocol investment, and then moved on to invest in NFT Alchemy, beginning with the underlying technological infrastructure.

SevenX invested in MintGate, BeeperDAO, and ShowMe in the intermediate tier (content and application layer), and Taker and NiftyPay in the higher layer of “NFT+DeFi.” SevenX also invested in MintGate in the intermediate tier (content and application layer).

Sixty-nine percent of SevenX’s total investment was made in Blocto, YGG, and Whaleshark, three of the world’s largest collector communities, as well as MYNFT, an interconnection platform with East and West founders, which is located in the wallet’s highest traffic tier.

- SevenX has been investing in the Arweave as a cutting-edge technology since its inception in 2020. “There will be an unparalleled burst of discoveries in the Arweave ecosystem in the next years,” said Eraser Li, a founding partner of SevenX Ventures. ARGO, the Apples augmented reality solution provider, enables developers to deploy DAPP to AR in real time, while ArDrive enables users to use augmented reality as their own data storage solution as easily as they would a network drive connected to the Internet. ARGO is a division of Apple Inc. Among the goods in the SevenX portfolio are the following:

Investing Into Immersion

Due to the decentralisation of the blockchain ecosystem, finance does not provide a comprehensive answer for a company to thrive in such uncertain conditions. Blockchain companies require more than just money to succeed; they also require the resources, tools, and expertise necessary to carry out their plans and achieve their objectives. This is where the character of SevenX comes into play.

While SevenX invests in blockchain-related enterprises, the company also provides strategic advising services to clients. In this programme, entrepreneurs are given the opportunity to evaluate their industry from the perspective of an omniscient observer – an outsider’s point of view. Furthermore, SevenX makes an attempt to understand the issues and hurdles that entrepreneurs have in order to propose solutions and opportunities. As a result, SevenX provides comprehensive help, which is why SevenX established a strategy known as “immersion investing.”

As a result of the team’s objective to encourage entrepreneurship and growth opportunities, its “immersion investment” approach has been affected. Let’s take the example of DODO, a decentralised trading platform that makes use of the Proactive Market Maker (PMM) algorithm. As an angel and private round investor, SevenX has provided DODO with consulting services in the areas of strategy, community, funding, and token economic design, among other things. Almost a year after its launch on DEX, the product has climbed to become one of the exchange’s top 15 trading volumes. Aside from SevenX, Maskbook was also supported in the global market by being affiliated with significant crypto funds, while Darwinia was rebranded as “Polkadot’s Golden Gate Bridge” to improve market recognition

Twitter: https://twitter.com/SevenXVentures

Website: http://www.7xvc.com/

One of Asia’s blockchain funds, SevenX Ventures, recently reported that the second round of its fund has gathered $30 million in total contributions. On August 16th, SevenX was able to recruit new limited partners (LPs) from a variety of backgrounds, including family offices, hedge funds, blockchain industry leaders, and internet firms. The firms stated that they want to proceed with Venture Fund II, which will be focused on DeFi, NFT, WEB3.0, Polkadot ecosystem, NEAR ecosystem, and Arweave’s new ecology of the data storage paradigm, among other technologies.

In any case, since its founding in 2020, the cryptocurrency investment firm SevenX has channelled these money to the benefit of a number of companies, including DODO, YGG, and Acala. These companies have seen great growth as a result of the investment made by SevenX Ventures. SevenX’s initial round of financing saw a 20-fold increase in its first year of operation, setting a new industry benchmark.

SevenX Ventures is currently in the process of developing its portfolio.

SevenX is on the lookout for long-term value projects that employ a long-term development mentality and an underlying logic viewpoint to make a positive difference in the world. As indicated by the following data, SevenX’s portfolio has a large number of success stories:

SevenX is an angel investor in the DeFi industry, having invested in Opium, Shield, Kine, InsureAce, and DODO as one of the first investment funds dedicated to the field. They were also among the first investors in Furucombo, and in 2020, they made a strategic investment in Zerion, which is a virtual reality platform.

SevenX has developed a matrix layout in the NFT field, which was accomplished via the use of its own logic framework. Together with Framework and Pantera, it co-led the Rangers Protocol investment, and then moved on to invest in NFT Alchemy, beginning with the underlying technological infrastructure.

SevenX invested in MintGate, BeeperDAO, and ShowMe in the intermediate tier (content and application layer), and Taker and NiftyPay in the higher layer of “NFT+DeFi.” SevenX also invested in MintGate in the intermediate tier (content and application layer).

Sixty-nine percent of SevenX’s total investment was made in Blocto, YGG, and Whaleshark, three of the world’s largest collector communities, as well as MYNFT, an interconnection platform with East and West founders, which is located in the wallet’s highest traffic tier.

SevenX has been investing in the Arweave as a cutting-edge technology since its inception in 2020. “There will be an unparalleled burst of discoveries in the Arweave ecosystem in the next years,” said Eraser Li, a founding partner of SevenX Ventures. ARGO, the Apples augmented reality solution provider, enables developers to deploy DAPP to AR in real time, while ArDrive enables users to use augmented reality as their own data storage solution as easily as they would a network drive connected to the Internet. ARGO is a division of Apple Inc. Among the goods in the SevenX portfolio are the following:

Putting Money Into Immersion

Due to the decentralisation of the blockchain ecosystem, finance does not provide a comprehensive answer for a company to thrive in such uncertain conditions. Blockchain companies require more than just money to succeed; they also require the resources, tools, and expertise necessary to carry out their plans and achieve their objectives. This is where the character of SevenX comes into play.

While SevenX invests in blockchain-related enterprises, the company also provides strategic advising services to clients. In this programme, entrepreneurs are given the opportunity to evaluate their industry from the perspective of an omniscient observer – an outsider’s point of view. Furthermore, SevenX makes an attempt to understand the issues and hurdles that entrepreneurs have in order to propose solutions and opportunities. As a result, SevenX provides comprehensive help, which is why SevenX established a strategy known as “immersion investing.”

As a result of the team’s objective to encourage entrepreneurship and growth opportunities, its “immersion investment” approach has been affected. Let’s take the example of DODO, a decentralised trading platform that makes use of the Proactive Market Maker (PMM) algorithm. As an angel and private round investor, SevenX has provided DODO with consulting services in the areas of strategy, community, funding, and token economic design, among other things. Almost a year after its launch on DEX, the product has climbed to become one of the exchange’s top 15 trading volumes. Aside from SevenX, Maskbook was also supported in the global market by being affiliated with significant crypto funds, while Darwinia was rebranded as “Polkadot’s Golden Gate Bridge” to improve market recognition.