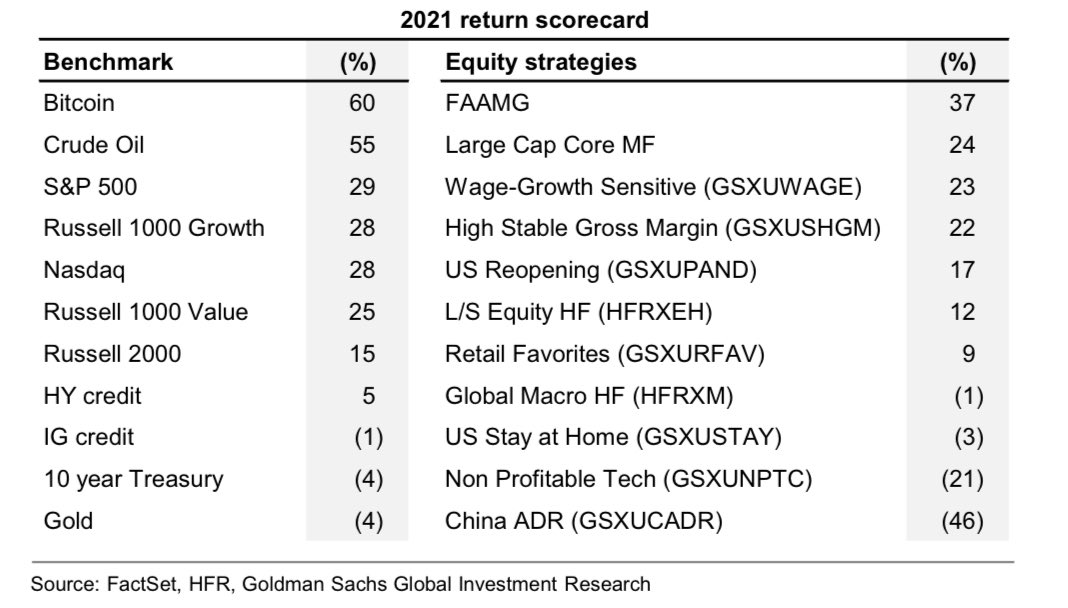

According to the Goldman Sachs 2021 return scorecard, bitcoin returned more than 60% in the previous year. A consequence of this has been Bitcoin’s ascension to the top of all capital markets, including benchmark and thematic equity baskets. Global indices such as the Nasdaq, the Russell 1000, and the S&P 500 all returned less than 30% over this period.

According to the most recent data from Goldman Sachs, bitcoin has cemented its position as the preferred store of value among numerous financial institutions.

Even high-value equities baskets such as FAAMG underperformed Bitcoin in 2021, with gains of only 37 percent compared to the cryptocurrency.

While gold did not fare well on Goldman Sachs’ scorecard, it was the most significant loss. Despite having a return on investment of 4 percent, it was ranked near the bottom of the list, right close to 10-year Treasury bonds.

According to the prevailing market sentiment toward gold, which has seen an increasing number of investors reject gold as a safe haven asset class, this is a positive development.

Last year, Bitcoin outperformed all capital markets, including global indices such as the S&P 500 and Nasdaq, as well as stocks such as FAAMG, according to the bank’s return scorecard for the year 2021.

Gold Losing its Spot as A Store Of Value

Changing viewpoints, however, reveals that Bitcoin is gaining popularity with traditional investors, who see it as a go-to store of value asset that has outperformed all other forms of capital market investment in the past year.

The volatility of the cryptocurrency market last year produced some unexpected winners in the industry, with new meme coins leading the way in terms of profits, which in some cases exceeded hundreds of percent in other situations. With its modest gains of approximately 60%, Bitcoin has been largely written off as a viable option for most crypto investors in the world of Flokis and Shibas.